Content

Some accounting and finance professionals even receive access to employee benefits, especially if they are registered with a staffing firm. Although temporary and part-time employment both offer professional flexibility, it’s important to recognize they aren’t synonymous. A temp job can be anything from a few hours a week to a 40-hour-plus commitment, but it lasts for only a specific period of time — anywhere from a day to several months. Part-time accounting and financial jobs, on the other hand, require fewer hours per week than full-time jobs but may be ongoing. The Bureau of Labor Statistics defines part-time positions as 1 to 34 hours per week. Much of the confusion about part-time accounting work is because of the sometimes interchangeable use of the terms bookkeeper and accountant.

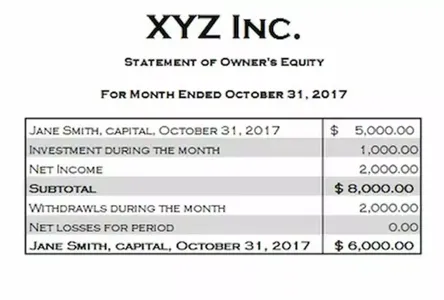

Please refer to a complete list of Educational Policy and Accreditation Standards. The university’s MSW program has been accredited by CSWE since 1991. A forensic accountant’s daily responsibilities can vary by organization, but they typically involve analyzing complex financial data to uncover potential wrongdoing. A company’s total accounts payable balance at a specific point in time will appear on its balance sheet under the current liabilities section. Accounts payable are debts that must be paid off within a given period to avoid default.

Finance Business Partner – Part Time

They must also be able to discuss the results of their work both in meetings and in written reports. A few states allow a number of years of public accounting experience to substitute for a college degree. Accountants and auditors examine financial statements for accuracy and conformance with laws. Accountants and auditors prepare and examine financial records. We need an accountant to do our day to day accounting on Xero.

They combine accounting and financial information to guide business decision making. They also understand financial and nonfinancial data and how to integrate information. The information that management accountants prepare is intended for internal use by business managers, not for the public. In addition to examining and preparing financial documents, accountants and auditors must explain their findings.

TAX SENIORS – Remote OR Hybrid (multiple locations)

Flagstar Bank is a full-service institution providing individuals with services such as checking, savings, auto loans, and credit cards. An agent-owned, cloud-operated brokerage, eXp Realty helps real estate agents interact, collaborate, and learn no matter where they are. EmploymentCrossing is great because it brings all of the jobs to one site.

- Accountants work with business leaders in small companies or with managers in large corporations to ensure the quality of their financial records.

- Still others work with individuals, advising them on important personal financial matters.

- A temp job can be anything from a few hours a week to a 40-hour-plus commitment, but it lasts for only a specific period of time — anywhere from a day to several months.

- Some routine accounting tasks may be automated as platforms such as cloud computing, artificial intelligence , and blockchain become more widespread.

- These public accountants combine their expertise in data management, economics, financial planning, and tax law to develop strategies for their clients.

Accountemps, for example, offers these resources for bookkeepers, accountants and financial workers free of charge and makes them available 24/7. While an effective tax accountant typically helps to properly prepare tax returns for clients, sometimes individuals and organizations improperly file their taxes, whether intentional or not. A company can report that it lost money in a given year when it actually made a profit, or an individual can claim certain deductions or withhold information about additional income when filing a yearly return. Even government agencies such as the FBI are in need of effective forensic accountants to investigate the financial activities of suspected and wanted criminal parties and organizations. Even outside of this window, tax accountants still have other duties. Robert Half, a recruiting firm, notes how “organizations have audits, strategic financial planning, bookkeeping and many other tasks to deal with year-round” in which tax accountants can prove beneficial.

Search

part time accounting accountants have a broad range of accounting, auditing, tax, and consulting tasks. Their clients include corporations, governments, individuals, and nonprofits. Accountants and auditors prepare and examine financial records, identify potential areas of opportunity and risk, and provide solutions for businesses and individuals. They ensure that financial records are accurate, that financial and data risks are evaluated, and that taxes are paid properly.

Duties include preparing financial reports, processing payroll checks, invoicing and tracking down delinquent accounts. Some firms will ask you to monitor checking and savings accounts and track credit card bills, too. If you have the qualifications, you may be in charge of helping to prepare annual tax returns.

Social Media Specialist

Save time and find higher-quality jobs than on other sites, guaranteed. Lincoln Financial Group offers financial products that help customers achieve retirement income security. The company offers annuities, life insurance, and long-term care protection. This is a part-time position and the right candidate must be proficient using a variety of Microsoft products. Please note that all salary figures are approximations based upon third party submissions to SimplyHired or its affiliates. These figures are given to the SimplyHired users for the purpose of generalized comparison only.

An accountant may help to organize a midsized company’s financial information, while a tax auditor may focus on determining if the company paid the necessary amount owed to the tax authority . The main responsibilities vary significantly for each position, but they’re all focused on interpreting and analyzing financial information. Finance and insurance $79,310Management of companies and enterprises 78,540Government 77,290Accounting, tax preparation, bookkeeping, and payroll services 77,080 Most accountants and auditors work full time.

Reconciles vendor statements and confirms all invoices are accounted for. From £45,000 to £65,000 per annum depending on experienceA part qualified accountant will be considered for this role and the role does offer part time study support. A Part qualified accountant with Financial Accounting experience ideally for a Financial Services firm. The Community Accountant will work closely with the existing Community Accountant to build upon an already successful and vital service. Temporary and part-time jobs offer the opportunity to better balance work and personal priorities because you’re not tied to a traditional full-time schedule. Working parents, students and those nearing the end of their careers, in particular, are often attracted to this type of work for this very reason.

- PlacementIndia.Com does not take responsibility for payments made to any third-party promising job opportunity.

- Please refer to a complete list of Educational Policy and Accreditation Standards.

- A part-time accountant has the skills and education of a full-time accountant but works part-time hours.

- The role is for an AAT qualified accountant, or part qualified or by experience, who has previously worked in a firm of chartered or certified accountants only.

- Angie Nelson began working from home in 2007 when she figured out how to take her future into her own hands and escape the corporate cubicle farm.

Leave a reply