Contents:

The currency forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets to hedge against future exchange rate fluctuations, but speculators take part in these markets as well. Forex trading in the spot market has always been the largest because it trades in the biggest underlying real asset for the forwards and futures markets. Previously, volumes in the forwards and futures markets surpassed those of the spot markets. However, the trading volumes for forex spot markets received a boost with the advent of electronic trading and the proliferation of forex brokers.

GBP/JPY Forecast: Pound Slips Against Yen Slightly – DailyForex.com

GBP/JPY Forecast: Pound Slips Against Yen Slightly.

Posted: Mon, 06 Mar 2023 03:31:12 GMT [source]

A prerequisite for success in intraday trading is having sufficient market knowledge. A popular form of trading which you may be aware of is trading on Foreign exchange, or Foreign currency. The forex market is where banks, funds, and individuals can buy or sell currencies for hedging and speculation. The foreign exchange, or Forex, is a decentralized marketplace for the trading of the world’s currencies.

Explore the markets with our free course

As intraday trading is executed on lower timeframes, the overriding market trend can differ from one day to the next. Forex day trading is a trading system that consists of opening and closing trades in the same day. This type of trading can be practised in any market but is most frequently applied to the Forex-, stock- and index markets. Countries like the United States have sophisticated infrastructure and markets to conduct forex trades.

A typical https://g-markets.net/ day trader will select a time frame to operate in and a currency pair or pairs to trade within that time frame. Day trading in the forex market involves buying and selling foreign currency pairs to make short-term profits before closing out all positions by the end of the trading day. Because of the substantial amount of attention involved, forex day trading isn’t for everyone. Another key tool in a day traders kit is the platform they use.

Scalping and trading the news require a presence of mind and rapid decision-making that, again, may pose difficulties for a beginner. Finally, keep in mind that if you trade onmargin, you can be far more vulnerable to sharp price movements. Trading on margin means borrowing your investment funds from a brokerage firm. It requires you to add funds to your account at the end of the day if your trade goes against you. Therefore, using stop-loss orders is crucial when day trading on margin.

- For example, the best platforms in this space offer commission-free trading at a spread of less than 1 pip.

- Range trading,sometimes referred to as channel trading, is a day trading strategy that starts with an understanding of the recent price action.

- Another important consideration is selecting a reliable forex broker.

- The first trade was the first slow down after a very strong move higher.

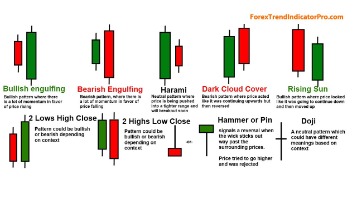

- There are many candlestick setups a day trader can look for to find an entry point.

As we’ve discussed, a how to day trade forex trader needs strategies to keep a cool head to make the right decisions when markets are volatile. While it may feel painful when you make a good trade on a demo account but don’t see any of the profits from it, just remember, it is better to win fake money than to lose real money. Your trading plan should be able to adapt to new market conditions. As the moods of investors are always changing, causing sways in exchange rates, you should be able to tap into these shifts while staying within your goals.

Trading News

She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans. That means having the best trading platform for your Mac or PC laptop/desktop, having a fast and reliable asset scanner and live stream, and software that won’t crash at a pivotal moment. If you stumble across a word or phrase that leaves you scratching your head, refer back to this day trading dictionary and chances are you’ll get a quick and easy explanation.

Whether you’re a technical or fundamental trader also matters when deciding upon a suitable trading strategy. Technical traders tend to initiate trades off market signals, while fundamental traders base their decisions on underlying economic conditions and relevant news items that move the market. Once you’ve decided on a strategy, you can practice in a demo account and create a trading plan. Forex day traders can often profit from the notable volatility that follows an important news event when the news deviates substantially from the market’s expectations. Accordingly, news traders might regularly review calendars of economic data releases and news feeds to identify possible trading opportunities.

Types of Day Trading

Follow the on-screen instructions by entering your personal information and contact details. It is hoped that the value of EUR/USD falls, which would mean that your sell order returns a profit. However, in the event that the pair increases in value, you will never lose more than 3% of your stake. The drawback of news trading is that events that cause substantial movements in prices are usually rare.

- In the previous section, we have touched on the importance of basing investment decisions on a trading strategy.

- If you’re ready to place your first-ever forex day trading position right now – you might want to consider eToro.

- One reason is that you aren’t required to exercise your option to make a profit on it.

- Not only do you need to know your strategies well, but you need to be adaptable, adjusting your methods to capitalize on opportunities.

Some forex scalpers also employ forex robots to fully automate their trading plans. Some scalpers set pip goals per trade and many use technical analysis to generate signals for initiating their trades. For example, a scalper might watch a 1-minute chart and have a goal of making 5 pips per trade. Money flows uses volume and price rather than just an asset’s price to determine the direction that the market will move.

In addition to providing their own proprietary trading platforms, many brokers run the MT4 and MT5 platforms, letting you open a demo account without committing your own funds. This is an excellent way to evaluate a broker’s general execution services. A positive money flow tends to appear when the price is rising and it’s negative when it’s falling. Day traders use this strategy to decide whether an asset may be oversold or overbought.

When a trend is discovered, this allows you to place a suitable trade to profit from your findings. This is in stark contrast to other fx trading strategies – with swing traders having the flexibility to keep a position live for several weeks. With this in mind, the profit margins available when forex day trading will be somewhat modest. Volatility refers to the intensity and frequency of the market movements. Short-term trading requires high levels of volatility as price needs to move sufficiently in a limited time frame.

What is the Best Technical Indicator for Forex Day Trading

Yes – the foreign exchange market is arguably the best asset class to target as a day trader. Not only can you trade 24/7 at industry-leading fees, but forex attracts trillions of dollars worth of volume each and every day. Plus, when trading major forex pairs, you will benefit from super-low volatility levels. After all, this often sees day traders place multiple positions throughout the day, and thus – not all will return a profit. On the contrary, losing a trade is just part and parcel of this industry.

Bloomberg recently reported record numbers in trading activity meaning that traders are as busy as ever. Beyond the stock market, the forest market is looking to boom as renewed optimism of a COVID vaccine and a new US president drive market confidence. In day trading, the best charts are often going to be the ones you can understand quickly. If you are most comfortable with a simple line chart, then that will be better for your trading than a candlestick chart. Some brokers offer additional market information, such as more details on bid-ask spreads and market volatility by paying for a premium service.

Mostof my day trades in the forex market are based on these simple concepts. For simplicity, assume I am talking about an uptrend unless otherwise noted. To consider how to trade forex or futures successfully, you must understand your motivation. Do you see your buying and selling activity as a business, which will pay your mortgage and all other expenses reliably into the future?

Recent reports show a surge in the number of day trading beginners. But unlike the short-term trading of the past, today’s traders are smarter and better informed, in part due to trader academies, courses, and resources, including trading apps. Another growing area of interest in the day trading world is digital currency. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business.

A limit order is the automatic closing of a position at the point where the trader perceives a profitable run could end. A trader will inspect chart patterns to identify typical highs and lows during the day while keeping a close eye on the difference between these points. Using indicators on the shorter time frame chart will give you an idea of when to time your entries. For an example of this style of trading, see Pip Surfer’s world-renowned Cowabunga System.

Leave a reply